6 Common Reasons for Unpaid Invoices

Everyone has an excuse to why an invoice is not paid which is why we would like to talk about 6 Common Reasons for Unpaid Invoices. We hope the simple insight to these situations which we deal with will help you avoid debts in the future. Although we can talk about the economy, wages and personal issues like divorce and mortgages, we will tackle the reasons you will find resistance for payments.

The Evader

To get stated, we will look at some of the types of people you encounter. The evader can be one of the trickiest to get payment from.

The Evader will do everything to screen your calls, ignore your emails and not be home when a visit is made. Despite your work being completed, The Evader will cover their eyes and pretend you cannot see them. One of the ways to find these debtors prior to work is to keep an eye on the amount of personal info they give you. This is more important if the work to complete is not at a home address.

An example of this is a purchase of services or goods at your business and all the customer provides is a name “Matt” and a phone number. It is extremely easy for a customer to disappear if you cannot follow-up with other avenues. To avoid this, the easy way is to make sure that there are forms signed or detailed information is given including full name, phone, address and email addresses. These are obviously not full proof, but will confirm later on if your client is evading or simply lost their phone.

Many of the debts we have submitted to us have only a first name and a disconnected phone number. We use Skip Tracing tactics to find these individuals and recover owed money. The more information we have on the individual, the more likely we are to have a successful Skip Trace. This blog form Business News Daily by Max Freedman sums up the general gist of what Skip Tracing is and how it can help. We found it helpful in explaining the process.

The Fighter

The Fighter will do anything, blame anyone and anything at all costs. Whether it is threats and yelling or passive aggressive comments and stubbornness, this debtor can be a handful to deal with. This debtor will usually start to show just before a job starts or in the middle of the work.

Signs of The Fighter include:

- Overly specific requests on a straight forward job

- Over-communicator

- Past contractors ceasing work from non-payment

- Bad Credit Rating

- Principle > Payment

- Micro Managing

- Demands outside scope of work

- Early on threats to change circumstances or price reduction

Unfortunately, many of the signs can be of a conscientious client just making sure the job is done right. The Fighter can be difficult to deal with as sometimes the way they feel trumps any attempt to convince them the amount is owed. The main points they will attack are listed below as other common reasons of non-payment.

Work Order

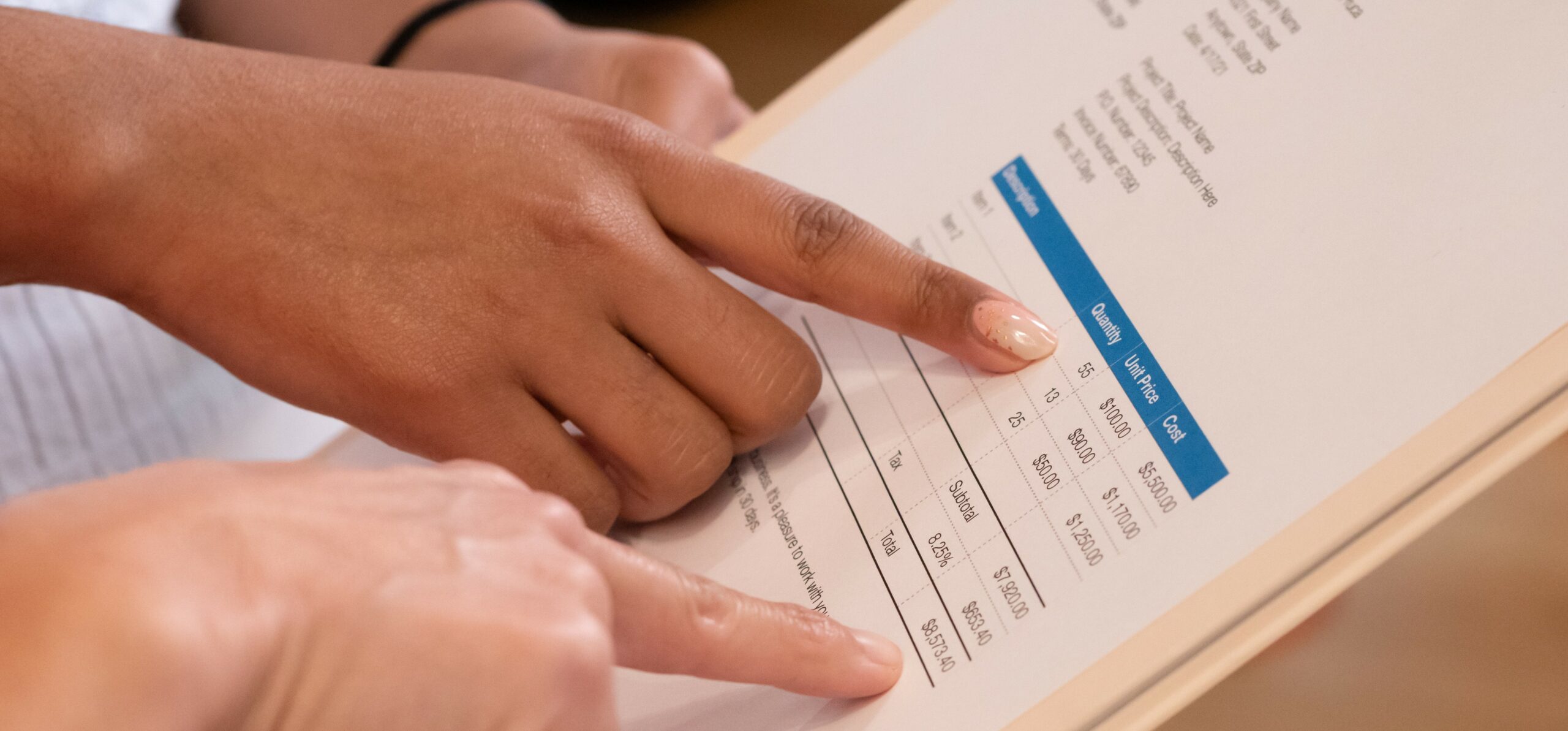

Despite solar panels being installed, a lounge room cleaned or a car fixed, The Fighter and other debtors try to claim they never asked for the work to be done. Sometimes this is fair, other times it’s ridiculous. To avoid debts and even collect in Debt Recovery, make sure that the scope of work is in writing. Whether it is a text, a workorder or a signed contract, any indication that the client asked for and received the item is the best way to ‘unbalance’ any claim suggesting otherwise.

Variations

Variations amount to roughly 30% of debts we deal with. As with the work order, these are usually unpaid as the client claims no-one asked for the work to be completed. This easily ranges from an extra room cleaned for $60 to $80,000 of scaffolding provided.

We cannot stress enough how important it is to get written permission for the extra work. There are ways to do this like QLD’s QBCC variation forms for QBCC licensee. This can be a lot of extra work and fuss to fill out and are not available for all businesses. We are currently putting the final touches on our own online variation forms.

We have created this service to provide a free and quick way to make sure variations are not the reason for non-payment.

Click HERE to register interest in the variation form system to be released late 2022.

Disputes

“There is a 2mm scratch on the window so I am not paying the final $20,000.”

As humans, reason seems to elude us at times. Disputes vary and can be difficult to deal with. You would know this well as a business owner yourself. The trick is always to find where to swallow the pride and loss and where to stand your ground. As per the real example we have dealt with above, a client withholding $200 for this may be reason to drop the matter. A client withholding 1k+ would be a very different story depending on your own business’s situation.

HRG believes in 2 simple options – There is money owed, or not.

Unless a contract says otherwise, an unreasonable amount withheld for a minor issue is not acceptable. As with all issues regarding non-payment, we urge for all important communication to be confirmed in writing. This will assist in negotiation, mediation, debt collection and even escalation to court.

Financial Hardship

As a business owner, this one can take guts to handle. Unfortunately, if someone has no money to pay, there is no money to pay.

That being said, a client legitimately in this situation should be willing to enter into a payment agreement to resolve. This is the main way to collect in this instance other than getting a court order to do the same or pushing for bankruptcy.

If an agreement is to be made in this instance, we always attempt to:

- Find a repayment amount which is meaningful in both parties situations

- An amount which the debtor will not default

- REGULAR payment amount – usually weekly, fortnightly or at most, monthly.

- Room for further negotiation if circumstances change

- Direct Debit so payment does not rely on the client’s memory or choice

Final Thoughts

HRG is mainly focused on debt recovery once things go bad but we want to do what we can to avoid this in the first place. We attempt to help by supplying free info and resources such as:

- Protection Audits

- Variation forms (coming soon)

- Debt Collection consultations

- Credit File information

- Other resources such as logos for your invoices

Our hope is that these items will mitigate unpaid invoices for your business and also remind you that we are here to help in your time of need. No matter the reason for non-payment, there are always ways to resolve or recover payment in the situation. We hope we can guide you to the correct path to success in this area.

Latest Posts

Payment Agreements

Establishing effective payment agreements lies at the heart of the debt collection process. Whether it's arranging a swift $100 payment within a week or...

Avoid Using Debt Collection

Many businesses avoid using debt collection as they have no use for it. By our existence as a company, you can tell many others cannot avoid needing...

Better Accounts Equals Better Profit

A good business owner is always counting the cost of the work they do. For a builder, this is moving their margin when material costs rise (thanks COVID),...